- Ed Slott’s IRA Corner

- Why the “Opportunity Cost” Argument About Roth Conversions Doesn’t Hold Up

Why the “Opportunity Cost” Argument About Roth Conversions Doesn’t Hold Up

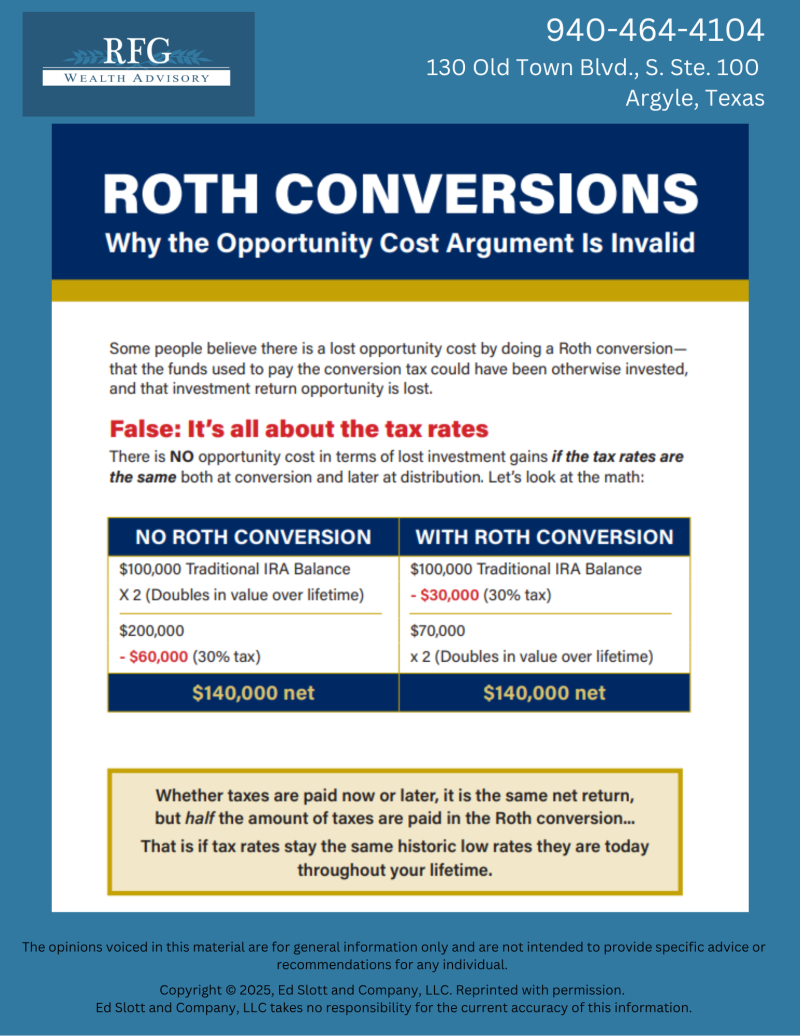

If you’re evaluating whether a Roth IRA conversion makes sense, you’ve likely heard one of the most persistent myths: paying the tax up front on a conversion means losing out on investment gains that could have compounded in a retirement account. But as retirement tax expert Ed Slott and top financial planners emphasize, this notion falls apart if tax rates remain consistent today and at the time of your IRA withdrawals.

Truth in the Roth Conversion Opportunity Cost Numbers

Consider this scenario widely cited by Ed Slott: Suppose both Jane and Fred each have a $100,000 traditional IRA invested identically. Over a decade, both balances double to $200,000. Jane converts her entire IRA to a Roth, paying 30% tax upfront—$30,000—and invests the remaining $70,000 in her Roth. That grows to $140,000 by the time she retires, which she can withdraw income‑tax‑free. Meanwhile, Fred leaves his $100,000 intact. It doubles to $200,000, but when he takes distributions, he pays $60,000 of tax (again 30%), leaving him with $140,000—exactly what Jane ends up with. So, if tax rates stay the same, there’s no opportunity cost: the net result is identical.

Why It May Still Be Smart

Whether converting makes financial sense depends on more than just comparing tax rates. The real advantage of a Roth conversion emerges when you believe your future tax rate—or that of your heirs—will be higher than your current rate. In such a case, paying tax now can lock in savings later, making converted funds grow tax-free. This strategy is especially compelling for higher-income savers, those approaching RMD age, or those concerned about future tax hikes.

If you can pay conversion taxes from outside your IRA (e.g., taxable accounts), this can increase the benefit, because the entire IRA balance then remains in the Roth to grow tax-free.

When Roth Conversion Opportunity Cost Becomes Real

If tax rates drop after your conversion, or if your heirs end up paying lower rates on distributions. Conversion may cost more in tax than it saves. Luckily, key strategies like spreading conversions over multiple years, converting during retirement gap years, and using the BETR (break-even tax rate) analysis help you minimize risk and maximize long-term outcomes.

Why It Matters for You

For high-earning professionals planning their legacy—and especially those with significant retirement savings—the timing and structure of Roth conversions matter. A well-executed conversion strategy could reduce future taxable income (and Medicare surcharges like IRMAA), sidestep RMD complications, and simplify retirement cash flow. Conversely, missteps could mean paying too much tax unnecessarily today.

Ready to Explore Whether a Roth Conversion Fits Your Strategy?

Download our guide, “Roth Conversions – Why the Opportunity Cost Argument Is Invalid”, for a step-by-step look at how the math works and which scenarios make conversion powerful—or risky.

When you’re ready, reach out to our advisors at RFG Wealth Advisory in Argyle, Texas. Contact us at 940‑464‑4104 or schedule a virtual consultation online. RFGWealthAdvisory.com As a fee-only, fiduciary firm, our only goal is to help you plan and execute innovative financial strategies.

Financial success doesn’t happen by chance; it comes with guidance, planning, and execution. Let us help you. Call us Today!

Disclaimer

Financial Success Doesn’t Happen by Chance.

Contact lead advisor Chris Robinson with RFG Wealth Advisory in Argyle, Texas to discuss your questions.

RFG Wealth Advisory is an independent, fee-only Registered Investment Advisor firm in Argyle, Texas. At RFG Wealth, our fiduciary duty ensures your interests always come first, and we maintain a transparent fee structure for your peace of mind. Contact us today!

Investment advice is offered through RFG Wealth Advisory, a Registered Investment Advisor.

Schedule a Virtual ConsultationChris Robinson is the managing partner and founder of RFG Wealth Advisory, which he founded in 1995. He is a current resident of Argyle and native of Denton, Texas.

- Chris Robinsonhttps://rfgwealthadvisory.com/author/chris-robinson/

- Chris Robinsonhttps://rfgwealthadvisory.com/author/chris-robinson/

- Chris Robinsonhttps://rfgwealthadvisory.com/author/chris-robinson/

- Chris Robinsonhttps://rfgwealthadvisory.com/author/chris-robinson/

Related Posts

“These materials have been independently produced by RFG Wealth Advisory. RFG Wealth Advisory is independent of, and has no affiliation with, Charles Schwab & Co., Inc. or any of its affiliates (“Schwab”). Schwab is a registered broker-dealer and member SIPC. Schwab has not created, supplied, licensed, endorsed, or otherwise sanctioned these materials nor has Schwab independently verified any of the information in them. RFG Wealth Advisory provides you with investment advice, while Schwab maintains custody of your assets in a brokerage account and will effect transactions for your account on our instruction.”

RFG Wealth Advisory is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). Registration does not imply a certain level of skill or training, nor is it an endorsement by the SEC or other regulators. RFG Wealth Advisory only provides investment advisory services in jurisdictions where it is registered or qualifies for an exemption. This website is for informational purposes only and does not constitute legal, tax, or accounting advice. For more information, see our Form ADV and Form CRS, available at the bottom of this page.

RFG Wealth Advisory

130 Old Town Blvd., S, Ste. 100

Argyle, TX 76226