Services

Investment Management

Our investment portfolios are designed to capture close to the full return of the stock market by keeping internal fees very low, avoiding mistakes by active managers and avoiding excessive taxation due to turnover.

We primarily use exchange traded funds, or ETF’s to construct our investment portfolios. ETF’s often track an Index but can be traded like a stock.

The ETF’s we primarily use are:

Markets are unpredictable, costs are forever.

- We use very low-cost index ETFs (Exchange traded funds), primarily Vanguard and iShares.

- Custody at Charles Schwab & Co., Inc. – No trading cost for ETFs and stocks.

- Markets are unpredictable, costs are forever. The lower your costs, the greater your share of an investment’s return and the greater the potential impact of compounding. Research suggests*** that lower-cost investments have tended to outperform higher-cost alternatives. (Vanguard – Principles for Investing Success)

- In investing, there is no reason to assume that you get more if you pay more. (Vanguard – Principles for Investing Success)

- Investors cannot control the markets, but they can often control what they pay to invest. That can make an enormous difference over time. (Vanguard – Principles for Investing Success)

Tax efficiency is an important consideration for many investors. The tax efficiency of any portfolio is strongly related to the investment approach.

- Tax efficiency is an important consideration for many investors. The tax efficiency of any portfolio is strongly related to the investment approach.

- Our ETF** portfolios are designed to be broadly diversified with lower turnover. That design inherently lends itself to a higher degree of tax efficiency.

- Index funds can be an excellent value for investors trying to keep expenses low and profits high.

- The market’s pricing power works against mutual fund managers who try to outperform through stock picking or market timing. As evidence, only 22% of US equity mutual funds and 10% of fixed income funds have survived and outperformed their benchmarks over the past 20 years. (Dimensional Fund Advisors – Mutual Fund Landscape 2020)

**ETF’s trade like stocks, are subject to investment risk, fluctuate in market value, and may trade at prices above or below the ETF’s net asset value (NAV). Upon redemption, the value of fund shares may be worth more or less than their original cost. ETFs carry additional risks such as not being diversified, possible trading halts, and index tracking errors.

*** Harbron, Garrett L., Daren Roberts and Jeffrey Johnson, 2016. The case for low-cost index-fund investing. Valley Forge, Pa.: The Vanguard Group

Index funds offer one way to achieve broad diversification and can be easily positioned to help meet your risk and return requirements.

- Index funds offer one way to achieve broad diversification and can be easily positioned to help meet your risk and return requirements.

- Holding securities across many market segments can help manage overall risk. But diversifying within your home market may not be enough. Global diversification can broaden your investment universe.

- A sound investment strategy starts with an asset allocation suitable for the portfolio’s objective. (Vanguard – Principles for Investing Success)

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk. International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investor

Markets are unpredictable, costs are forever.

- We use very low-cost index ETFs (Exchange traded funds), primarily Vanguard and iShares.

- Custody at Charles Schwab & Co., Inc. – No trading cost for ETFs and stocks.

- Markets are unpredictable, costs are forever. The lower your costs, the greater your share of an investment’s return and the greater the potential impact of compounding. Research suggests*** that lower-cost investments have tended to outperform higher-cost alternatives. (Vanguard – Principles for Investing Success)

- In investing, there is no reason to assume that you get more if you pay more. (Vanguard – Principles for Investing Success)

- Investors cannot control the markets, but they can often control what they pay to invest. That can make an enormous difference over time. (Vanguard – Principles for Investing Success)

Tax efficiency is an important consideration for many investors. The tax efficiency of any portfolio is strongly related to the investment approach.

- Tax efficiency is an important consideration for many investors. The tax efficiency of any portfolio is strongly related to the investment approach.

- Our ETF** portfolios are designed to be broadly diversified with lower turnover. That design inherently lends itself to a higher degree of tax efficiency.

- Index funds can be an excellent value for investors trying to keep expenses low and profits high.

- The market’s pricing power works against mutual fund managers who try to outperform through stock picking or market timing. As evidence, only 22% of US equity mutual funds and 10% of fixed income funds have survived and outperformed their benchmarks over the past 20 years. (Dimensional Fund Advisors – Mutual Fund Landscape 2020)

Index funds offer one way to achieve broad diversification and can be easily positioned to help meet your risk and return requirements.

- Index funds offer one way to achieve broad diversification and can be easily positioned to help meet your risk and return requirements.

- Holding securities across many market segments can help manage overall risk. But diversifying within your home market may not be enough. Global diversification can broaden your investment universe.

- A sound investment strategy starts with an asset allocation suitable for the portfolio’s objective. (Vanguard – Principles for Investing Success)

**ETF’s trade like stocks, are subject to investment risk, fluctuate in market value, and may trade at prices above or below the ETF’s net asset value (NAV). Upon redemption, the value of fund shares may be worth more or less than their original cost. ETFs carry additional risks such as not being diversified, possible trading halts, and index tracking errors.

*** Harbron, Garrett L., Daren Roberts and Jeffrey Johnson, 2016. The case for low-cost index-fund investing. Valley Forge, Pa.: The Vanguard Group

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk. International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investor

Focus on what you can control:

Create an investment plan to fit your needs and risk tolerance

Diversify globally

Manage Expenses, turnover, and taxes

Stay disciplined through market dips and swings

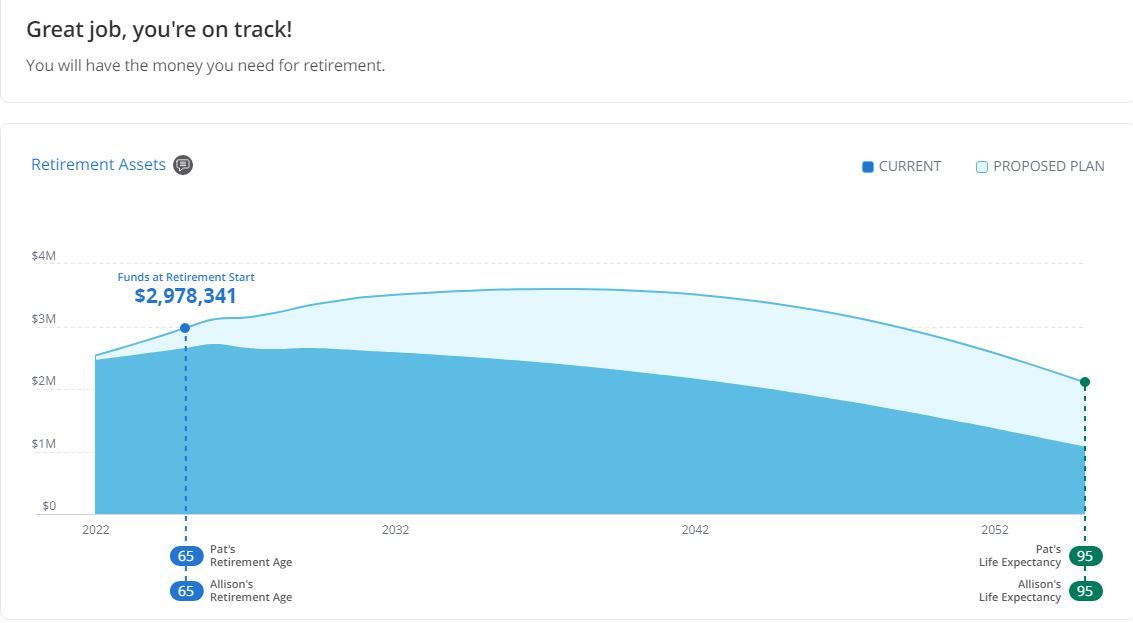

Probability of Retirement Success

What is your Probability of Retirement Success (PRS) score?

You want to retire with as much certainty as possible, living the lifestyle you always dreamed of. What is your current probability of this happening? Are you taking the right steps towards that dream?

Here are some questions you might ask yourself:

-

When can I retire?

-

How much do I need to retire?

-

Am I saving enough?

-

What income can I dependably expect to receive in retirement?

-

What is your probability of a successful retirement?

-

Input your Data

-

We will calculate your Probability of Retirement Success (PRS)

-

We send you your PRS score with suggestions to improve your score

What is your Probability of Retirement Success?

Financial Blueprint

What is a Financial Blueprint?

A Financial Blueprint is a set of plans to help audit and organize your financial life.

A Financial Blueprint starts with an in-depth analysis of all aspects of your current financial picture to identify any weaknesses or areas of opportunity. Then, we make recommendations to help you define and achieve the financial future you desire.

Just like an architect helps you create plans for the home of your dreams, we help you create your plans for a successful financial life.

Topics Covered in Blueprint:

Investment Planning

Review Balance Sheet, Investments, Asset Allocation / Portfolio, Risk Tolerance, Stock Concentration, Company Stock / Restricted Shares, and Investment account fees

Cash Flow & Budget

Retirement Planning

Risk Management & Insurance

Planned Giving

Income Tax Planning

Estate Planning

SWOT Analysis

Financial Goals & Bucket List

So what is a Financial Blueprint?

Goal Tracking Technology

A goal without a plan is just a wish. Being able to track progress is very rewarding and will help you maintain focus on what you are trying to accomplish.

We utilize technology to help you stay up-to-date and on track for your financial goals.

These goals may include:

Education Funding:

Other Financial Goals:

Retirement:

Free Assessment

- What is your PRS score? Are you on track?

- Fee breakdown. How much are you currently paying for your investments?

- Performance review. Can your investments be improved?

“These materials have been independently produced by RFG Wealth Advisory. RFG Wealth Advisory is independent of, and has no affiliation with, Charles Schwab & Co., Inc. or any of its affiliates (“Schwab”). Schwab is a registered broker-dealer and member SIPC. Schwab has not created, supplied, licensed, endorsed, or otherwise sanctioned these materials nor has Schwab independently verified any of the information in them. RFG Wealth Advisory provides you with investment advice, while Schwab maintains custody of your assets in a brokerage account and will effect transactions for your account on our instruction.”

The LPL Finanical registered representatives associated with this website may discuss and/or transact business only with residents in the states in which they are properly registered or licensed. No offers may be made or accepted from any resident of any other state.