Maximize Your Retirement Savings in 2025

As we enter 2025, now is the perfect time to revisit your retirement savings strategy. 2025 Retirement Plan Contribution Limits have been updated. With updated contribution limits and new opportunities

As we enter 2025, now is the perfect time to revisit your retirement savings strategy. 2025 Retirement Plan Contribution Limits have been updated. With updated contribution limits and new opportunities

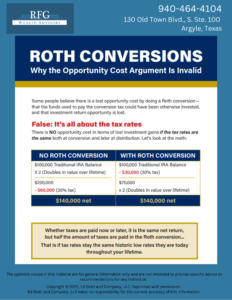

If you’re evaluating whether a Roth IRA conversion makes sense, you’ve likely heard one of the most persistent myths: paying the tax up front on a conversion means losing out

If you’re helping your family plan for college this fall, you may already know that 529 plans provide great tax-free savings for education. But thanks to updates from the SECURE 2.0

It may seem counterintuitive, but there are situations where choosing not to accept an inheritance can be the smartest move. Tax reasons, impacts on your own estate planning, or unintended

Accessing your retirement funds before age 59½ might seem like a last resort. Still, sometimes life throws unexpected challenges our way—medical bills, education costs, a job loss, or even helping

If you’re passionate about making a lasting difference—both for your loved ones and the causes you care about—then using your IRA to benefit a charity may be a smart and

Inheritance can be a powerful way to preserve the legacy of loved ones while shaping the financial future of generations to come. However, the emotional weight of inheriting or passing

Your estate plan is a personal and powerful way to protect everything you’ve worked so hard for. Whether you’re just beginning to explore your options or have already taken steps

2025 has begun with a BANG! Join us here for some of our adventures! RFG Wealth Advisory – Team News February 2025 Click the picture above to enjoy. This newsletter

“These materials have been independently produced by RFG Wealth Advisory. RFG Wealth Advisory is independent of, and has no affiliation with, Charles Schwab & Co., Inc. or any of its affiliates (“Schwab”). Schwab is a registered broker-dealer and member SIPC. Schwab has not created, supplied, licensed, endorsed, or otherwise sanctioned these materials nor has Schwab independently verified any of the information in them. RFG Wealth Advisory provides you with investment advice, while Schwab maintains custody of your assets in a brokerage account and will effect transactions for your account on our instruction.”

RFG Wealth Advisory is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). Registration does not imply a certain level of skill or training, nor is it an endorsement by the SEC or other regulators. RFG Wealth Advisory only provides investment advisory services in jurisdictions where it is registered or qualifies for an exemption. This website is for informational purposes only and does not constitute legal, tax, or accounting advice. For more information, see our Form ADV and Form CRS, available at the bottom of this page.

RFG Wealth Advisory

130 Old Town Blvd., S, Ste. 100

Argyle, TX 76226

Our websites require some cookies to function properly (required). In addition, other cookies may be used with your consent to analyze site usage, improve the user experience and for advertising.