- Ed Slott’s IRA Corner

- Roth IRA vs. 529 Plan: A Smart Savings Strategy for High Income Families

Roth IRA vs. 529 Plan: A Smart Savings Strategy for High Income Families

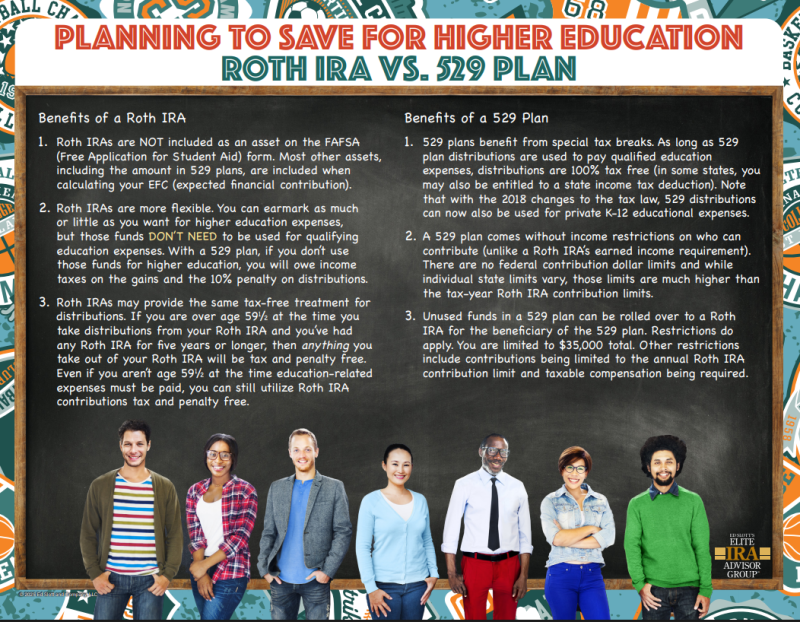

If you’re helping your family plan for college this fall, you may already know that 529 plans provide great tax-free savings for education. But thanks to updates from the SECURE 2.0 Act, they now offer added flexibility. This is especially true when your loved one doesn’t use all the funds. Let’s explore how Roth IRAs and 529 plans work together to benefit the next generation.

Why a 529 Plan Often Still Tops the Choices for Education

A 529 plan remains a tax-smart way to save for qualified education costs. This includes college or even private K–12 tuition, thanks to recent tax law updates. Withdrawals for qualified expenses are 100% tax-free at both federal and state levels. Plus, many states offer tax deductions or credits for contributions. There’s no restriction on income level for contributing, and most state limits on contributions are well above what a typical family needs.

Why a Roth IRA Could Be the Better Choice When Needs Change

While Roth IRAs do have eligibility limits, these accounts offer unmatched flexibility. You can tap contributions tax-free anytime—for education, emergencies, or retirement—without penalty. Plus, unlike Roth IRAs, Roth plans aren’t counted in FAFSA calculations, so using a Roth IRA for educational expenses could help a student qualify for more financial assistance.

The Newest SECURE 2.0 Rollover Option: 529 → Roth IRA

Beginning January 1, 2024, families can roll up to $35,000 (lifetime maximum) from an established 529 plan into a Roth IRA owned by the 529’s beneficiary—TAX‑FREE—under SECURE 2.0 §126 . There are key rules:

- The 529 must be at least 15 years old

- Only contributions (and earnings) older than five years are eligible

- The rollover must not exceed that year’s Roth IRA contribution limit (e.g. $7,000 in 2024, $8,000 if age 50+). Plus it must be counted alongside any Roth or traditional IRA contributions that year

- The beneficiary must have earned income equal to or exceeding the rollover amount

- Importantly, Roth income limits do not apply, so this can benefit higher‑earning families.

Infractions such as trying to roll over newly added contributions or exceeding the lifetime cap could cause the IRS to treat the rollover as a taxable distribution.

Real-World Example: Turning Leftover College Savings into a Retirement Head Start

Imagine a child whose grandparents contribute $36,000 to a 529 plan at birth. After paying $200,000 in college costs, about $34,359 remains. The grandchild, now age 21 with $4,350 earned income, can roll that much into a Roth IRA. Each year afterward, up to the Roth limit (e.g. $7,000) can also roll over—so long as the plan and income qualifications are met—until the $35,000 cap is reached. Invested over decades, that small rollover could grow to over $1 million by age 60.

So, Which Vehicle Should You Use?

A 529 plan is still the best tool for paying education expenses—tax-free and purpose-built. But if your child doesn’t use all the money, the new rollover option offers a second life for those dollars: rolling into a Roth IRA to serve as long-term retirement savings. Just remember: the 529 must be long-established, and rollovers must follow the annual and lifetime limits precisely.

Our Support for Families Like Yours

If you’re unsure which strategy best serves your education and retirement goals—or how to structure the timing of Roth rollovers—click here to download our in-depth guide, “Planning to Save for Higher Education: Roth IRA vs. 529 Plan.”

You can also call our office at 940‑464‑4104 or book a free virtual consultation at RFGWealthAdvisory.com/virtualconsultation. At RFG Wealth Advisory in Argyle, TX, we help families like yours make informed decisions that minimize taxes and maximize long-term flexibility.

Financial success doesn’t happen by chance—it comes with planning and execution. Be an Elite Member of America’s IRA Experts, we stay up-to-date with the latest laws like SECURE 2.0 so you don’t have to. Let us help you design a plan that provides both education support and retirement resilience.

Related Posts

“These materials have been independently produced by RFG Wealth Advisory. RFG Wealth Advisory is independent of, and has no affiliation with, Charles Schwab & Co., Inc. or any of its affiliates (“Schwab”). Schwab is a registered broker-dealer and member SIPC. Schwab has not created, supplied, licensed, endorsed, or otherwise sanctioned these materials nor has Schwab independently verified any of the information in them. RFG Wealth Advisory provides you with investment advice, while Schwab maintains custody of your assets in a brokerage account and will effect transactions for your account on our instruction.”

RFG Wealth Advisory is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). Registration does not imply a certain level of skill or training, nor is it an endorsement by the SEC or other regulators. RFG Wealth Advisory only provides investment advisory services in jurisdictions where it is registered or qualifies for an exemption. This website is for informational purposes only and does not constitute legal, tax, or accounting advice. For more information, see our Form ADV and Form CRS, available at the bottom of this page.

RFG Wealth Advisory

130 Old Town Blvd., S, Ste. 100

Argyle, TX 76226